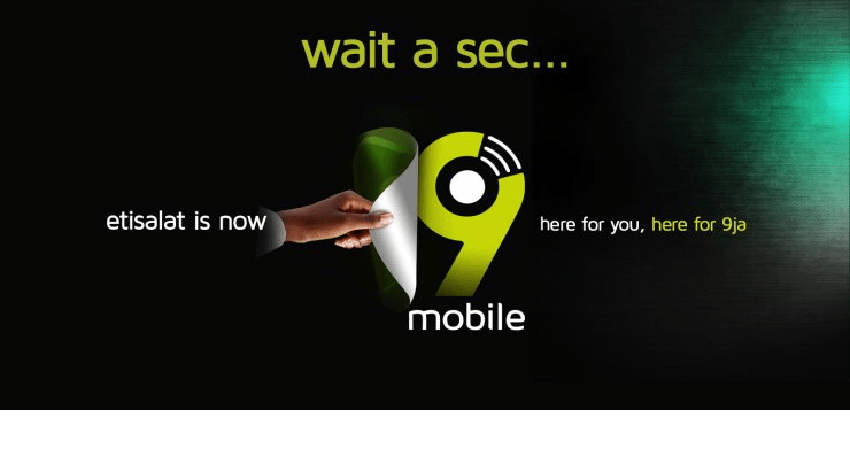

The change of the trading name of embattled telecommunication company Etisalat Nigeria to 9Mobile should naturally mean a breath of fresh air.

That Etisalat Nigeria now has a new board taking decisions for it should also bring good tidings.

However, experience has taught that a change of name doesn’t automatically translate to a change in fortunes.

As such, hard work and perhaps a miracle is what will see 9Mobile scaling the huddle before it.

Shareholders of the re-branded company will seek to see how the new board handles the herculean task of salvaging the company in six months, especially with a 1.2 billion debt staring it in the face.

Etisalat, prior to its change of name to 9Mobile controlled 13 per cent market share in Nigeria. However, it also had the burden of $1.2 billion debt from a consortium of 13 banks.

The crisis between Etisalat and the banks started in March when the telecoms company notified its debtors in February of its inability to service the debt due to the foreign exchange challenges in the country.

Subsequently, the Chief Executive Officer (CEO) and Chief Financial Officer (CFO), Matthew Willsher and Olawole Obasunloye resigned their appointment.

The newly constituted board for 9 mobile includes Dr. Joseph Nnanna, a Deputy Governor, Operations at Central Bank of Nigeria (CBN), who is the Chairman of the board. Others are Boye Olusanya and Mrs. Funke Ighodaro who are the new CEO and CFO respectively. Oluseyi Bickersteth and Ken Igbokwe are non-executive directors on the board.

Interestingly, Olusanya was a former Deputy CEO and subsequently the Acting CEO of old Econet Wireless. Econet would be remembered as a pioneer telecommunication company in Nigeria, but the memories of how it offloaded its 4.2 per cent stake at $127million in Airtel Nigeria remains legendary.

9 Mobile has already began a low scale promotion of its brand with message being sent around and an unveiling event holding. However, nothing massive is expected till either the merger or sales.

Indeed, judgment day will come in six month for the new board, as its bankers wait to get their money.

Post Views: 1,478